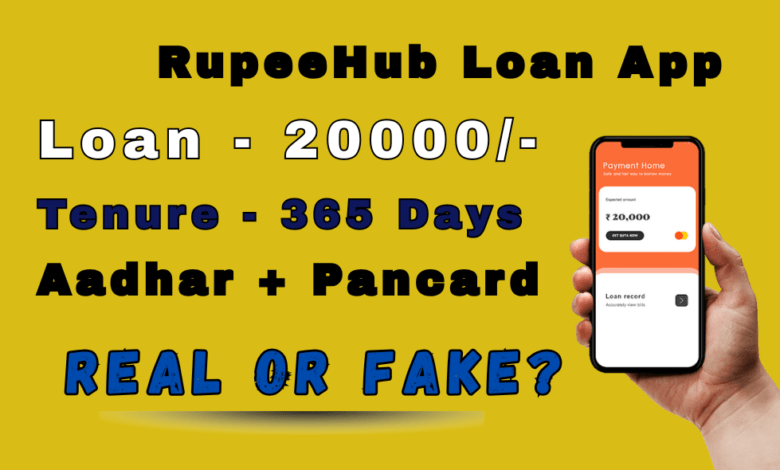

Rupee Hub App – Your Go-To Platform for Instant Loans and Online Earnings

In today’s fast-paced world, financial flexibility has become a necessity rather than a luxury. Whether it’s an emergency expense or the need for some extra income, having access to instant financial support can be life-saving. That’s where the Rupee Hub App comes into play. Designed to provide instant personal loans and a range of online earning opportunities, this Android app has become increasingly popular among users looking for reliable financial solutions.

In this comprehensive guide by Technewztop, we explore the features, benefits, user experience, and potential drawbacks of the Rupee Hub App. Let’s delve into how this app can help you manage your finances efficiently.

What is the Rupee Hub App?

The Rupee Hub App is a multifunctional Android application that serves as both a personal loan provider and an online earning platform. It enables users to apply for instant personal loans, earn money by completing tasks, and withdraw funds directly to their bank or Paytm accounts.

Available on Google Play Store, the app is designed to offer a smooth and intuitive user experience. With flexible borrowing options and multiple ways to earn, it caters to a wide range of users — from salaried employees to students and freelancers.

How to Download and Set Up

Step-by-Step Guide to Downloading the App

Getting started with the Rupee Hub App is simple. Here’s how you can download and install it on your Android device:

- Open Google Play Store on your smartphone.

- In the search bar, type “Rupee Hub App“.

- Click on the app icon from the search results.

- Tap the “Install” button.

- Once installed, open the app and begin the registration process.

Registration and Verification

To access the app’s features, you must register using your mobile number and email address. The app also requires users to complete a quick verification process, which may include submitting a valid ID and basic personal details.

Rest assured, the app is built with data privacy in mind. Your information is encrypted, ensuring a secure user experience.

How to Apply for a Personal Loan

One of the standout features of the Rupee Hub App is its hassle-free loan application process. Whether you need money for medical expenses, education, travel, or business, you can apply for a personal loan in just a few steps.

Steps to Apply

- Launch the App and log in with your registered mobile number.

- Navigate to the Loan Section on the dashboard.

- Enter Loan Details such as the desired loan amount, repayment tenure, and the purpose.

- Upload Documents such as ID proof, address proof, and bank statements.

- Submit the Application and wait for verification.

If your application is approved, the loan amount is disbursed instantly to your linked bank account.

Loan Repayment and Interest Rates

The app offers flexible repayment tenures, usually ranging from a few weeks to several months. Interest rates may vary based on your credit profile and loan amount, so it’s advisable to read all terms carefully before proceeding.

Earning Money with the Rupee Hub App

Beyond loans, the Rupee Hub App provides users with opportunities to earn money online. This dual functionality makes it a versatile financial tool.

Refer and Earn

The app has a referral program that allows you to invite friends. Here’s how it works:

- Share your referral code with friends.

- When they sign up and use the app, you earn a cash bonus.

- Bonuses can be withdrawn to your Paytm or bank account.

Complete Tasks to Earn

The app offers simple tasks such as:

- Watching promotional videos

- Completing surveys

- Clicking on ads

Each task earns you a certain amount of money, which accumulates in your wallet and can be withdrawn once you reach the minimum threshold.

Withdrawal Process

Users can easily withdraw their earnings to:

- Paytm wallet

- Bank account

The process is quick and usually takes just a few hours, making it highly convenient for users looking for instant cashouts.

User Reviews and Ratings

The Rupee Hub App has received a mix of reviews from its user base. While many users appreciate its quick loan disbursal and easy interface, some have raised concerns about customer support and limited loan options.

Positive Feedback

- “Great app for quick loans. Helped me during a financial emergency.”

- “I love the referral program. Easy way to earn some side income.”

- “User interface is simple and clean.”

Constructive Criticism

- “Customer support could be more responsive.”

- “Loan tenure is too short for larger amounts.”

- “App sometimes lags on older devices.”

Despite the mixed reviews, the app continues to improve with regular updates and feature enhancements.

Is the Rupee Hub App Safe to Use?

Security is a major concern for users dealing with financial apps. The Rupee Hub App assures users of data protection through encryption and secure login methods.

Data Privacy

The app only asks for essential personal information and clearly outlines its privacy policies. Users are advised to read the permissions before installation and avoid sharing sensitive details outside the app interface.

Tips for Safe Usage

- Use a strong password and avoid public Wi-Fi while logging in.

- Keep your app updated to the latest version.

- Contact support only through official channels listed in the app.

New Features in the Latest Version of Rupee Hub App

With regular updates, the app has introduced several new features to enhance user experience:

Flexible Loan Amounts

Users can now select from a broader range of loan amounts, making it suitable for both minor expenses and larger needs.

Enhanced UI/UX

The interface has been redesigned for smoother navigation and quicker access to key features.

Expanded Earning Options

The app now supports more earning tasks, including high-paying surveys and promotional offers.

Pros and Cons of Using

Pros

✅ Instant loan approval

✅ Multiple income opportunities

✅ User-friendly design

✅ Quick withdrawal process

Cons

❌ Customer support is inconsistent

❌ Limited repayment options

❌ May not be suitable for large loan seekers

Alternatives to Rupee Hub App

If you’re exploring other financial apps, here are a few reliable alternatives:

CashBean

Offers quick loans with minimal documentation. Ideal for emergency situations.

Navi Loan App

Known for its transparent terms and flexible repayment options.

mPokket

Popular among students, this app offers micro-loans with easy approval.

Final Thoughts by Technewztop

The Rupee Hub App stands out as a dual-purpose platform offering both instant personal loans and online income opportunities. While it’s not without its flaws, its ease of use, quick disbursal, and multiple income streams make it a valuable financial tool for Android users.

The Technewztop team recommends using the app responsibly. Always read the fine print, understand the interest rates, and avoid over-borrowing. With the right approach, the Rupee Hub App can help users gain much-needed financial stability.

Frequently Asked Questions

What is the Rupee Hub App, and how does it work?

The Rupee Hub App is an Android-based application designed to offer instant personal loans and online earning opportunities. Users can download it from the Google Play Store, apply for a loan with minimal documentation, and even make money through referrals and task completion. The app combines lending and micro-task platforms, making it useful for users seeking financial support and supplemental income.

Is the Rupee Hub App safe to use for personal loans?

Yes, the Rupee Hub App follows standard security protocols to ensure user data and transactions are safe. However, users should always read the terms and conditions, check required permissions before installing, and avoid sharing sensitive information unless necessary. The Technewztop team recommends installing apps like Rupee Hub only from verified sources like Google Play.

How quickly can I get a loan disbursed via Rupee Hub?

If your loan application is approved, the Rupee Hub App usually disburses funds within a few minutes to a few hours. The time depends on the verification process and bank processing times. For most users, the experience is smooth and timely, especially if all submitted documents are accurate.

Can I use Rupee Hub App without applying for a loan?

Absolutely. Even if you don’t need a loan, you can still use the Rupee Hub App to earn money online. You can refer friends, complete small tasks like watching videos, or engage in surveys and advertisements to earn rewards and transfer them to your Paytm or bank account.

What should I do if I face issues with the Rupee Hub App?

If you encounter any problems such as login errors, loan processing delays, or payment issues, you should first check the app’s support or help section. If unresolved, reach out to customer care through the app or the official website. Technewztop also advises users to read reviews and feedback to better understand common user concerns and resolutions.